Since Then – and Before Now

In Scientific news, the Japanese land a rover on an Asteroid, they generate a Human Egg Cell from a blood sample and we also discovered a buried lake on Mars. In Religious news, The Pope acknowledges acts of Priests cover-up in Pennsylvania’s catholic pedophile ring, and asks for forgiveness.

In the U.S., Los Angeles bans the sale of fur! And then there is Trump. He invoiced NATO nations, met Putin in Helsinki and invited him to the White House, chose Brett Kavanaugh as his Supreme Court nominee, calls out everyone in the United Nations, and gives a 12B subsidy for American farmers impacted during the NAFTA re-draft with Mexico and in the last minutes, Canada.

Facebook’s lacking security measures dramatically impact its value. Apple became the world’s first trillion dollar company, then followed by Amazon. David Wells, CFO of Netflix steps down. JP Morgan hires ex-Google exec. Apoorv Saxena for A.I. Division, and Elon Musk smokes a joint on Joe Rogan Experience podcast.

Iran warns of retaliation to a “U.S. led” coalition attack on a parade Sept 22nd. Imran Khan (Ex-Cricketer) elected PM in Pakistan and promises to clean up corruption and bridge relations with India. Turkey’s economic troubles may find support through Balkan investments. Malcolm Turnbull ousted as Australian PM, and Colombia withdraws from Union of South American Nations (UNASUR) due to group’s support of Venezuelan dictatorship.

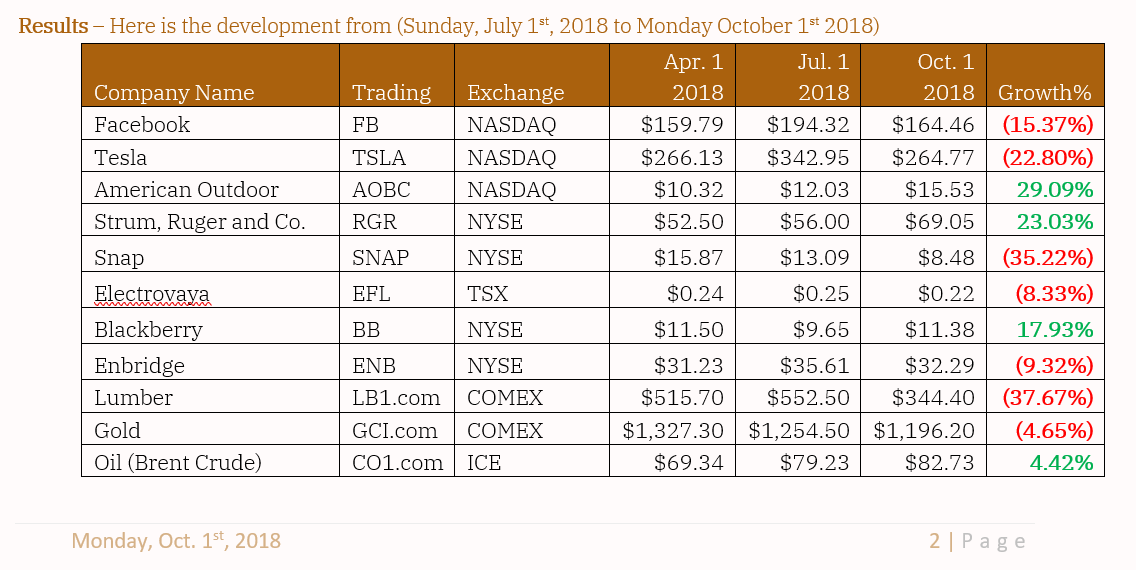

Ø Facebook – needed security investments force the stock to plunge 20% (7.25.18) and is even lower still.

Ø Tesla – is fined 40M and Musk termed as Chairman for SEC violations, this quarter stock is down 20%

Ø Gun Manufacturers – saw a collective 20% (+) rise in stock price with upcoming U.S. mid-term elections.

Ø Double Down – The results from last issue suggestions, reveal the continued risk with Snap, Electrovaya and Enbridge which drop still, only Blackberry rose back to earlier year numbers.

Ø Lumber – prices peak at unmanageable levels and have drop 50% in 3 months.

Ø Gold – continues its drop, in Q3 by 4.65%, with some risk investors betting on a good gold year in 2019.

Ø Oil – remains stable, with strong growth Brent Crude raising up 4.42% with supplies tightened on Iran.

Forecast

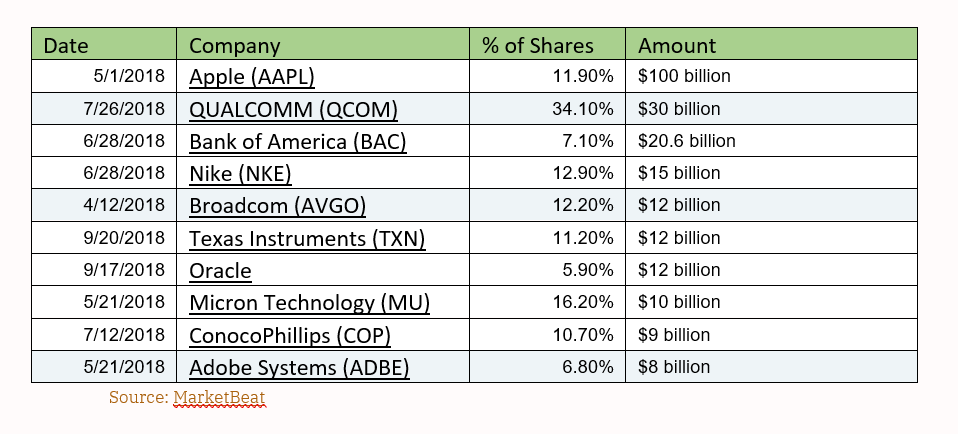

Buyback bucks

When a company repurchases its own stock, a buyback, this represents a way of returning money to shareholders. However, if a company’s drive is to reward stockholders, then dividends are simpler (Of Note: Q1/Q2 2018 dividends grew 7.8% to $220.8B). And others claim investor returns are not the best use of company Assets, as they could pay their employees a larger wage, invest in infrastructure or spend on R&D.

The vagueness of ‘buybacks’, has the public questioning the agenda’s when making this purchase.

The true positive reason to buy back stock is to capture the stock an unregularly low point, which the company knows will rise over time. However, the negative reasons are to inflate key ratios and evaluations, to hold off predators, or create misrepresents Return on Asset % or Earnings per Share % by decreasing assets without growing earnings.

Prior to the Reagan Era, company ‘buybacks’ were mostly illegal as the process could be used to misdirect the free market with self-purchased growth. In 1980’s, and in general when capital gains taxes are lowered through government cuts, then Companies will often offer C-Level Employees stock incentives through options.

This last quarter, Berkshire Hathaway released their limits on their own buy back limits from 4B, and with 100B in their war chest – this could reflect a new investment strategy. One big news story last Quarter, was Apple’s evaluation peaking at 1 Trillion USD – this was closely tied to their extensive stock buybacks.

Both Walgreens and Reuters are considering buying up to 10B, along with other companies we can expect this trend to continue in 2018, above 2x that of 2017.

The U.S. Tax cuts in March 2018, are directly tied to the large growth in DOW Jones, NASDAQ and overall stock market exchanges – as company ‘buybacks’ are creating a lot of activity.

Be on notice of large investors are dumping stock. Back in June 2018, a record 23.7B was dumped onto the market, which could reflect a collapsing bubble to be outsourced to the main street.

A question of this activity is if the stock market is stable and on verge of a bubble?

Politics & Religion

Deficit & Trade Wars

Russia is Dumping U.S. Bonds

Russia holds 14.9B of U.S. bills, notes and bonds. Although still a lot, they have dropped their holdings fasting than any nation in recorded history. Once a top 10 holder of US Treasuries, their reduction starting May 2017 hit dramatic drop in April 2018 from 96.1B to 48.7B and continued to shrink. Other nations have fluctuated their stake but never in such amounts or percentage of their holdings, and at this point Russia’s reasoning have not been stated. The reaction is likely to sanctions on Russian Oligarchs and Officials, or that Russia is simply placing holds through the Cayman Islands skewing the results.

Of the 33 major holders in this highly liquid market, it is topped by China (1.1T), Japan (1.1T) and Ireland at (297B). When the group’s holdings are pooled, it equates to 6T USD of the total 17T USD deficit.

Both Mexico and U.S. faced internal political pressure to close the new NAFTA deal (USM) before Enrique Pena leaves office Dec.1 and the U.S. have mid-term elections in November. Canada’s Chrystia Freeland, however, was not under the same pressure as Robert Lighthizer (USA) to hash out the specifics the deal, which underpins 1.2Trillion in trade.

Auto-parts, Dairy & Cross Border Limits

Since 1994’s NAFTA agreement, communal trade has quadrupled and specific to the U.S. they have increased their exports from 142B to 525B. The annual 0.5% increase of U.S. economic growth year over year is tied to auto industry, agriculture and imports of Oil. The renegotiation will result in refining a good deal.

At present, Mexico will see a rise in minimum wage to $16, for some auto workers, and they can form employee unions. Now more American made parts are required in the manufactured products being sold in U.S., encouraging

Although the Sunset Clause for review every 5 years has been extended to 16 years, with a 6 year review – which alleviated one of Canada’s primary concerns. A major sticking point is for the U.S. was access to Canada’s Dairy Market, which currently has a supply management clause. When the Trans Pacific Partnership (TPP) was struck, Canada already made concessions on the Dairy trade – so U.S. is was guaranteed to strike these same notes.

Ultimately, one win the U.S. is looking for is to increase cross border limits – which Mexico raised to $200 with no tariff, and has Canada to moved $150 from $20. The U.S. ultimately wanted $800 increase, with an impact to consumer online retail – but that would have resulted in a loss of 300,000 Canadian jobs.

Canada wanted to ensure environmental protections cannot be weakened to secure an investment deal, to kill the “Buy American” rules for U.S. Government projects, increase Visa regulations for professionals, and retain Chapter 19’s anti-dumping clause. In the case of Chapter 19, this was designed to raise an appeal process to unfairly subsidized government products from entering another country, the U.S. concession with NAFTA was not to ban these products outright. Canada needs to retain its right to subsidized certain industries, even if the use is only invoke in a minority, like with Softwood lumber in the recent years.

It is official, 1994’s NAFTA agreement is now 2018’s USMCA.

Sport & Combat

Hipsters play sport?

In 1989, Jeff Knurek created a game called Roundnet (as referred to as Revol or Slammo) based on the principals of volleyball. A game meant to be played in varying locations and environments, this has not really taken off.

In 2008, a group Kankakee, packaged the equipment as Spike Ball and found traction when Chris Ruder and team appeared on Shark Tank on in 2015. The boost from the show revealed its impact, despite the deal later falling apart, and they revealed a good technique for making a good deal with the Sharks.

How To Play:

The game is played with 4 people or more, and the teams circle around a small trampoline with a 12-inch ball and the game ensues. The server stands 6 feet from the net and identifies the receiver, and they begin the game by throwing the ball 4 inch into the air and aim for the net. The designated receiver has to play the ball by passing to their team mates or sending it across the net for their opponents to return. During their play, each team has up to 3 hits to set up a spike across the net. After the serve, players can move all around the net to prepare themselves for the reception of the ball, and during their return hits. However, when they are on defense – players must may an attempt to get out of the way of the ball or they will lose a point if they defensively block or hit the ball.

Most players will use their hands to play the ball, but they can not lift, catch or double hand a ball, however all body parts can be used to play a ball.

Traditionally people play till 21, with the rule they need to win by more 2 points. Points are scored when your opponent cannot return a rally, and they are lost when a team creates an infraction.

Mixtape X

The Best of the Past, Present and Future

Watch This

The best come out. Romain Gavras’ ‘Le Monde Est A Toi’ (Studio Canal), Harmony Korine’s ‘The Beach Bum’ (Neon) with Matthew McConaughney as is. The Coen Brothers ‘The Ballad of Buster Scruggs’ (Netflix), and a new season Nic Pizzolatto’s True Detective (HBO).

Top 5

1. The Cure – Jadu Heart (VLF Records)

2. Potato Salad – A$AP Rocky ft. Tyler, the Creator (AWGE)

3. My Life – ZHU ft. Tame Impala (Mind of a Genius)

4. Mona Lisa – Lil Wayne ft. Kendrick Lamar (Young Money / Republic)

5. White Flowers – Real Lies ft. Tom Demac (Kompakt)

Playlist

1. Dingbat Culture – Guitars and Dance Floors

2. Moonshine and Grit – Modern Country

3. Break Heat – What people listened to by the pool this summer

Retrospective

‘Hall & Oates’ have sold over 40M in records, making them the best selling musical duo in history. Here are some highlights from their body of work….

Hall & Oates

> Rich Girl from ‘Bigger than Both of Us’ (1976 – RCA Records)

> You Make My Dreams Come True from ‘Voices’ (1980 – RCA Records)

> Out of Touch from ‘Big Bam Boom’ (1984 – RCA Records)

> Maneater from ‘H20’ (1982 – RCA Records)

> I Can’t Go For That (No Can Do) from ‘Private Eyes’ (1981 – RCA Records)

Greatest Selling Album of All Time

The Eagles’ Greatest Hits (1971-1975) has overtook Michael Jackson Thriller to become the biggest selling of all time in the US - Recording Industry Association of America (RIAA)

Fadscape

Do you Juul?

As school started this 2018-19 year, principals and teachers have begun to notice kids taking longer and longer bathroom breaks – reminiscent of those days in the 70’s / ‘80’s where kids played cards and smoked all period. Kids nowadays congregate to perform on Insta-Live and Juul as they kill time.

Juul is an odorless way to get a nicotine fix, and with its tiny USB key-like design – it makes the perfect fit to surpass the stringent high school regulatory oversights.

Beyond just kids, Juul has jumped right into the market with sales topping at 1.1B in (Jul 17-Jul 18), accounting for 70% of the market. Juul is not just an E-Cigarette, it is also hip.

Where E-Cigarette has been somewhat in cultural limbo, tied with the Earphone Headpiece, for an authentic status. The traditional liquid Vape device is clumsy and often driven by folk trying to escape the trappings of true cigarette smoking. Although some Vape devices provide multi-use for marijuana, but if you wanted to go down that route there are many better ways.

However, Juul has been adopted by the youth as something of their own. It is compact, easy to use, easy to get away with and since the technology of vaporizing nicotine salts from tobacco, it packs a strong hit.