Genuine Report

Twenty Eighth Edition / 2023 (02)

The World

has changed

(April 1st 2023 - Paget, Bermuda)

The days the Earth stood still…. UFOs were acknowledged as a distraction. (See below)

Globe / Earth’s core reverses its spin for a new 70-year cycle, Australian biochemists discover an enzyme that converts hydrogen from the air into energy. Colossal biotech will introduce the Wolly Mammoth back into the world in 2028, studies of Paleolithic cave painting reveals abstract ‘dots’ may link lunar cycles to animal migrations, researchers discover ‘Lime Clasts’ role in the durability of Roman concrete.

International Criminal Court issues an arrest warrant for Vladimir Putin. Ghislaine Maxwell & Epstein client lists still not public.

Asia / China leads with long range Mach 12 Hypersonic Nuclear Arsenal, the U.S. move more training troops into Taiwan. China establishes global power presence with Russia alliance, and others asking for their support to broker a peace-deal with Ukraine. Some human cases of H5N1 Avian Flu strictly being monitored in Cambodia and throughout Asia. New Zealand P.M. Ardern resigns and replaced with Hipkins, Bangladesh President Chuppu elected as he ran unopposed.

Europe / Covert U.S. and Norway plans reveal sabotage plan on Nord Stream II, Germany sends Leopard 2 Tanks to Ukraine. Finland has been approved to become the 31st member of NATO. Protests in France due to rising retirement age leaves cities piled high with garbage, Dutch pro-farmer part BoerBurgerBeweging (BBB) win Senate elections showcase a revolt to emission regulations. Republic of Türkiye and Syria devastated by 7.5 magnitude Earthquake. Sturgeon steps down as first minister of Scotland, disastrous train crash in Greece leaves 60 dead.

South America / Argentina’s inflation spiked above 100% at rate reminiscent of the 1990’s, Peru’s Castillo tried to dissolve Congress ahead of coup but end up replaced by Boularte, Chilean Wildfires leave 2,700 sq. km devastated any 30 dead. Brazil’s President Lula and Venezuela President Maduro talking about re-opening embassies, Colombia’s president Petro still vows for peace despite end to ceasefire with Autodefensas Gaitanistas de Colombia (AGC) late March.

North America / Norfolk Southern train derailment spills 1.1M pounds of carcinogenic vinyl chloride in Ohio with concerns corporate interest has overridden public safety, EPAs approval of bio-fuel alternatives to petrol raises alarms of cancer-risks to public. Philadelphia alerted of a latex spill in Delaware river and advised not drink tap water due fear of contamination. Questionable intentions of a Chinese weather balloon revises North American radar search protocols revealing a lot of ‘unidentified aerial phenomena’. New NAFTA (USMCA) gets over automobile tariffs and tying loose ends, U.S. threats to respond to Sinaloa Cartel within Mexico is shot down harshly by President Obrador. Haiti is in disarray under President Henry and years of international persecution, while the West expects Canada to infuse themselves.

Africa and Middle East / Saudi Arabia and Iran side aside differences and agree to a bilateral deal brokered by China, the African Union met with 55 of 54 countries agreeing to AfCFTA terms of free trade agreements, while disinviting Israel in protest to treatment of Palestine. Israel’s contentious coalition government may overturn Supreme Court powers and lean into majoritarianism, resulting in mass protests and global concern for the region. Nigerian President Tinubu wins disputed election peacefully.

Politics & Religion

The Affairs of State

(March 30th 2023 - Toronto, Canada)

Earlier this month (March 11th) we noted that a run had hit a U.S. Regional Bank with a potential domino-effect, as Peter Thiel alerted risk, in Silicon Valley Bank (SVB).

In the following week, Crypto-friendly Signature Bank and other regional banks were exposed. The FDIC acted with an unprecedented move to contain concern by promising to expand the traditional insured coverage for $250,000 per account and moved it up to cover holder’s full balances, just to prevent a spread of bank runs.

Still risk exposure spread to large banks, first Credit Suisse hit as Saudi National Bank rose concern, then later Deutsche Bank in their Credit Default Swaps business.

With the U.S. National Debt at 31T, and the World Bank calling for a decade of no-growth, many in the West are concerned about growing deficits, hyperinflation and excessive global volatility.

In other news, China has been brokering major deals with the largest Oil-based economies this month. Saudi Arabia and Iran have agreed to an open forum of communication with Beijing’s influence, President Xi visited Moscow where they announced a strengthened Sino-Russian partnership and the entire BRICS community (see Edition 27) have taken on new applicants in droves.

This news is a direct attack on the U.S. Petrodollar (see Edition 24) as a global reserve currency, which looks to be challenged by the Yuan, as Shanghai Exchange Markets open to trade Oil in RMB.

Let’s look back at how we got here.

In 1971, President Nixon moved the U.S. off a gold backed reserve currency onto a fiat currency. In 1973, Vice President Kissinger drew up plans with King Faisal of Saudi Arabia to complete all Oil exchanges in U.S. dollars creating a new commodity-based currency– the Petrodollar.

Basically, if you wanted to buy Oil, post 1975, then you had to have U.S. currency on reserve.

In 2009, the illusive Satoshi Nakamoto released their white paper and issued the first Bitcoin (see Edition 7), and immediately Cryptocurrency garnered our attention, as a challenge to a commodity-based system. Since then, retail-investors and institutions (large-and-small) had the chance to test the Blockchain technology and exchanges to validate its value and ability to track individual transactions.

Now let’s look forward to what’s next.

The Blockchain model now poses a threat to the commodity-based markets, as a new ‘digital commodity’ that addresses all the concerns of ‘Fiat Currency’, while ungluing value based on a physical exchange of goods (particularly those with an exhaustive Climate Change Footprint – like Gold or Oil).

With test cases completed in the ‘Free Market’ in FTX and Binance (see Edition 27) and regulatory reviews of Ripple via SEC legal suits, we have a fully-fledged market-ready product for large banking institutions (e.g. Goldman-Sachs) or as a regulated government apparatus.

Coming this July, the Federal Reserve introduces a Blockchain version called ‘FedNow’.

With FedNow, or customer-to-government loan vehicles, commonly referred to a CBDC (Central Bank Digital Currency), there is a new government managed cryptocurrency ready for future currency exchanges.

From a governing body perspective, it is an efficient way to securely managed 24/7 currency supply, limit physical production of minted coins and cash, strangle black market exchanges, and collect taxes.

From a citizen’s perspective, rights regulations are needed to prevent overreach to freeze accounts, limit freedoms on personal spending, but does ease subsidies and universal basic income distribution.

If not monitored correctly, it can create a government overreach with dystopian results.

So how does this play out?

As the U.S. has weaponized the existing financial system through sanctions, restricting their described enemies from SWIFT exchanges, this has created a reaction from the global community. Now global national powers and corporate institutions are drawing a line in the sand for the next set of global currency exchange models, and either this ends with varying systems, or a face-to-face battle occurs, and everyone must choose a side.

BUSINESS

a domino and just bad timing..?

(March 11th 2023 - Toronto, Canada)

Silicon Valley Bank (SVB) CEO Greg Becker sold 3.6M worth of stock and paid Executives bonus’, just prior to the banks being seized on March 10th by the Federal Deposit Insurance Corporation (FDIC). SVB is proud of its venture capital support to Tech and Healthcare start-ups, but with the recent interest rate Fed hikes their 3X deposit growth from 2019 to 2021 began to falter. Their 1.6% return became less attractive then a 2-Year US Treasury Note, and clients began to pull deposits. As they ran at a loss, they could not buy confidence in a $21B fire sale of its fixed income portfolio and lost 86% of its stock value prior to its seizure.

The FDIC will return an insured $250K to clients, although 97% of them had higher values in deposits and a large portion of the total 175.4B in deposits will be lost.

The question remains is this a domino in the banking sector affecting JP Morgan and Bank of America,

or a classic case of business model in the wrong place and wrong time?

Tech Stocks have entirely lost their lustre

2022 was the Year of Reckoning for Tech Stocks as prices tumbled 30%, far greater than the S&P 500 drop of 20%. The results can be seen in excessive lay-offs at Amazon (21k), Google (12k), Meta (11k) Microsoft (10k), Salesforce and Slack (8k). A key is that AI solutions are replacing roles, however, others note that high interest rates may be the real cause.

Throughout the 21st century, the Tech Model was to build an attractive potential disruptive business plan, also generate a method to borrow extensive loans at low rates and support growth through the inorganic purchase of new start-ups and competition. With high interest rates, this model becomes challenged, as do loans to companies with this business model.

Tech is not going anywhere, but may take on a new shape and form.

Artificial Intelligence – It’s here.

This is the newest of new technologies and will challenge the old tech guard.

Recently Microsoft presented a new chat function into their Bing browser with ChatGPT built in, and Google has lost nights of sleep as their demonstration of their tool, Bard was so poor they lost 10B in stock swings within the week of the demo. BuzzFeed announces it will replace its entire Journalism staff to be replaced by AI articles. This is the area of the industry to invest in.

CyberSecurity – “Protect Yourself”

In an age of online convenience, we are also carefully and legislatively crafting an age of enhanced privacy. With regulatory supports through General Data Protection Regulation (GDPR), the need for corporate and technical security is a must. “Our “age of connectivity” brings an urgent need to safeguard networks and data. In response, organisations spent around USD 150 billion on cybersecurity in 2021, according to McKinsey”. This is the non-sexy part of Tech but definitely area of the industry to invest in.

Metaverse – Web 3.0

The pandemic revealed remote work was a possible, and now video recording/transcription of meetings present tools that surpass in person meetings. Although Meta may have jumped the gun on its investment and opportunity, Augmented Reality (AR) and Virtual Reality (VR) Commerce will stream towards the norm for the majority of financial exchanges, supporting companies in this sphere is a good idea.

Forecast

Infinitely better but for some, more than others.

(February 4th 2023 - Toronto, Canada)

The ‘Infinite Banking’ concept and its salesy introduction can almost seem too good to be true, and depending on your financial security and discipline - it may just be good and true. The principle is simple, purchase a Whole Life Insurance policy, then add some complexity as you act as your own bank by taking out investment loans against your savings and pay yourself back over time.

Equity Investors are weary, but insurance representatives love this product, and so do the wealthy.

In the 1980’s R. Nelson Nash develop the idea, later detailed in ‘Becoming Your Own Banker’, to reveal a tool to borrow against your own funds with beneficial tax implications. By purchasing a Whole Life Insurance Policy, you set up a program that will provide a benefit payout at the time of your death, and during your life will develop a cash value that you can leverage for emergencies or short-term investments.

How to Set Up an Infinite Banking Account via Whole Life Insurance

Find a reputable Insurer, and broker, to help select a Participating Whole Life insurance policy.

By continually paying a set premium (e.g., $200/month), you will be granted a specified death benefit (e.g., $250,000) that is payable to your beneficiary upon your death. During the lifetime of the policy, you will earn interest and dividends on the cash value of the account. The real key to the product is that you will be able borrow against your savings, while still earning interest on the full cash value.

Fixed Premiums: If you qualify your premium will be the same for life, regardless of age, health, and inflation. The earlier you start in life, the lower your premiums will be.

These fixed payments will apply to...

Fees and Operational Costs

Portion applied to the Face Value Death Benefit

Portion applied to Cash Savings Account

Face Value Death Benefits: Your beneficiary will receive the face amount of the policy when you pass away, tax-free, minus any outstanding policy loans.

Cash Savings Account (Tax-Free): The savings component of your policy will grow each year with interest and dividend payments without capital gains tax. The savings amount in the account can be borrowed against, with the insurer charging interest on the loan, although lower than the banking rates, until you make up the difference.

Add a Rider that ensure a beneficiary will also receive the Cash Value pay-out upon your death.

Add a Rider, to invest cash into your savings account earlier and build cash value faster than through your premium payments.

“Utilizing the infinite banking concept rather than traditional banks provides competitive safe growth rates, tax-sheltering, various protection benefits, and most importantly the continuous compounding of their liquid assets even while they’re being borrowed.” John ‘Hutch’ Hutchinson

The Participating Whole Life Insurance product is not a silver bullet for earning tax-free income, and equity investors could challenge there is a better use of funds. However, the product can be a good addition to a healthy investment portfolio - particularly for those who have discipline and funds to meet the premium, have long-term tax-free plans for their beneficiaries, and seeking future borrowing alternatives with no need for a credit check.

Sport & Combat

(March 2nd 2023 - Toronto, Canada)

The NFL and NHL having been updating their league rules and regulations to limit the impact of head injury, and to better address a public reaction from class action lawsuits. Now enter a new young league where head injury is the actual design of the game. The combat sport began in Russia and made its way to North America. Eventually a league developed in Missouri in 2017 soon found its attention interest with Logan Paul & Arnold Schwarzenegger and most importantly, Dana White.

What is PowerSlap?

It is the premier Slap Fighting Organization led by Dana White (of UFC) and sanctioned by the Nevada State Athletic Commission.

Another answer, is that it is the ultimate test of toughness.

And another answer, is that this is a reckless spectacle.

PowerSlap is televised on TBS and presents a battle between two combatants, who are center stage in a face-to-face showdown. The goal is very simple, to test who can withstand a 3-round battle to knock out their opponent, while they stand open to a direct hit to the head with no defenses to put up, not even a flinch.

To ensure there is a respect for sportsmanship, the Strikers are kept to basic rules to keep the event in line.

RULES

1) The first rule starts with a coin toss to determine to who is first on offensive.

2) The next rule relies on a small box at each of contestants’ feet, design to set the perimeter for how to control the stance to send and also receive the slap. Step outside the box and you default.

3) The defender must keep their hands behind their back and cannot flinch.

4) The striker can wind up a few times and needs to land their slap within 30 seconds.

5) The slap must be open palm and land the slap below the eye and above the jaw.

HOW TO WIN

If there is no Knock-Out (KO), or Technical Knock-Out (TKO), then the 3 rounds are decided by a 10-point judge decision.

FOULS

Striker fouls include clubbing, stepping, illegal wind-up and delay of game.

Defender fouls include flinching, blocking and delay of game.

Foul consequences include warnings, point deduction, loss of strike, re-strike and disqualification.

CINESCAPE

Don’t be Scared, Be Ready…

(January 21st 2023 - Paget, Bermuda)

The latest Film Award season kicked off in September, drawing buzz about the best in film and cinema, and landing real media attention with the Golden Globes (Jan. 10th), Sundance Film Festival (Jan. 19th), Screen Actors Guild (Feb. 26th) with the ultimate crescendo at the Oscars (Mar. 12th).

As per usual, cinephiles celebrate the best in drama, cinematography, costume, and animation, with a clear disregard for Comedy, Action and Horror. Regardless of their popularity, or maybe in spite of it, academies and critics pay limited attention to ‘popcorn’ movies.

Further still, Action and Comedy are treated by production houses as blockbusters and get studio commercials, memes, and interviews, but oddly enough Horror remains stuck with a cult following. If a Horror production does have critical merit, they may describe it as ‘Thriller’, similar to when an acclaimed Comedy may be classified as a ‘Dramedy’. Why does a link to Drama elevate the status of the film?

Are horror movies destined to remain a low art in cinema’s history or should they be recognized for pushing the medium forward?

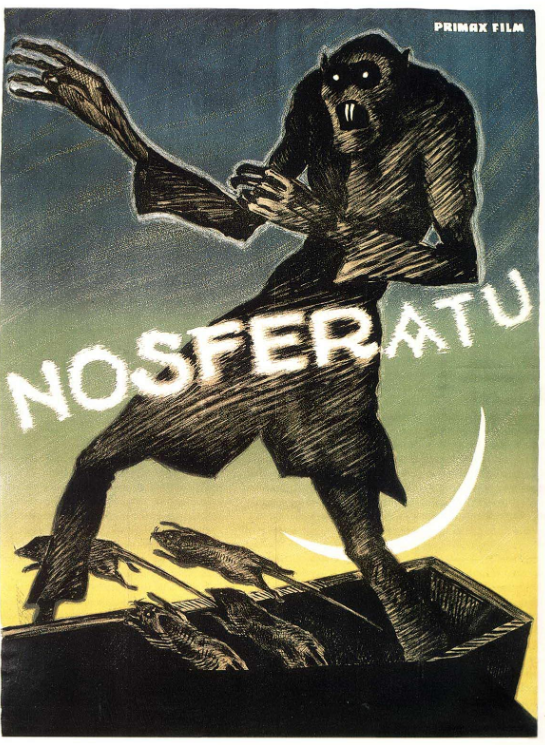

From its beginning, Hollywood was built early on with ‘Creature Features’ in the 1930’s when ‘Dracula’, ‘Frankenstein’ and ‘The Mummy’ made the mark on film, brought in ticket sales and spin-offs for 20 years. In 1950’s America, the fears of the Soviets and Nuclear disaster took root in ‘The Invasion of the Body Snatcher’s’ and ‘The Day the Earth Stood Still’, as did new levels of interactivity with 3-D glasses and buzzers under seat to jolt the audience. The largest impact to film and the genre appeared in 1960, when Alfred Hitchcock presented the slasher film ‘Psycho’ that he personally financed, due to disregard by the Hollywood establishment.

In the 1970’s, Horror entertained theatres with the low budget intensity and gore of ‘The Texas Chainsaw Massacre’, ‘Dawn of the Dead’ and the haunting satanism of ‘The Exorcist’. The 1980’s saw celebrated directors like Stanley Kubrick play with the medium in Stephen King’s ‘The Shining’, however, it was the VHS revolution that captured audiences with fears of serial killers punishing suburban teenagers in ‘Friday the 13th’, ‘Nightmare on Elm Street’, ‘Halloween’ and a set of low-brow movie series. The 1990’s ended with a genre shift to the handheld filming of the ‘Blair-Witch Project’, leading into the 21st century with ‘Cloverfield’ and “Paranormal Activity’ adapting to the new camera technique to scare audiences.

Is there a fear to promote and even celebrate Horror, because of its subject matter of gut-wrenching thrills and violence? Or is there a chance that Horror could come into a renaissance with new directors and production houses ready to take a chance?

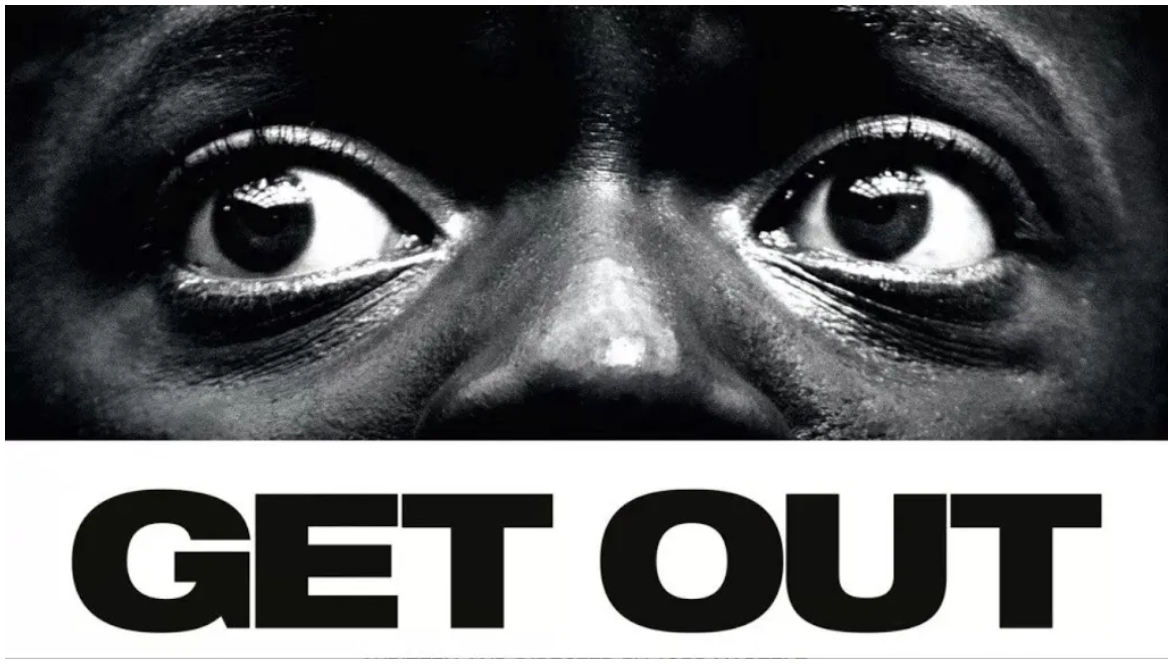

We find ourselves deeper into the 21st century, with new production houses (A24, Blumhouse) and some of our best directors (Ari Aster, Darren Aronofsky, Robert Eggers, Jordan Peele, Guillermo del Toro) interested in the genre. There is a surge of new opportunity, as new releases particularly via theatres release, challenge the narrative that streaming sites are the only way to make money in film today.

With paradigm shifts occurring in all elements of political life, technology and business, it could be that Horror is the most poignant way in film and cinema to express ourselves in these chaotic times.

MIXTAPE @*

Slow and Steady

Money better spent

The Best Horror Movies of Time

(circa all of time)

1. The Shining / Dir. Stanley Kubrick (1980)

2. Psycho / Dir. Alfred Hitchcock (1960)

3. The Night of the Hunter / Dir. Charles Laughton (1955)

4. The Exorcist /Dir. William Friedkin (1971)

5. Dracula / Dir. Tod Browning (1931)

6. Bride of Frankenstein / Dir. John Whale (1935)

7. Dawn of the Dead / Dir. George Romero (1978)

8. Halloween / Dir. John Carpenter (1978)

9. The Texas Chainsaw Massacre / Dir. Tobe Hooper (1974)

10. Alien / Dir. Ridley Scott (1979)

11. Get Out / Dir. Jordan Peele (2017)

12. Rosemary’s Baby / Dir. Roman Polanski (1968)

13. Hereditary / Dir. Ari Aster (2018)

14. Blair Witch Project / Dir. (1999)

15. Nosferatu / Dir. F.W. Murnau (1922)

(circa 21st Century)

1. Get Out / Dir. Jordan Peele (2017)

2. Hereditary / Dir. Ari Aster (2018)

3. The Witch / Dir. Robert Eggers (2015)

4. Insidious / Dir. James Wen (2010)

5. It Follows / Dir. David Robert Mitchell (2015)

6. The Babadook / Dir. Jennifer Kent (2014)

7. 28 Days Later / Dir. Danny Boyle (2003)

8. Saint Maud / Dir. Rose Glass (2019)

9. 10 Cloverfield Lane / Dir. Dan Trachtenberg (2016)

10. The Cabin in the Woods / Dir. Drew Goddard (2012)

11. Annihilation / Dir. Alex Garland (2018)

12. Under the Skin / Dir. Jonathan Glazer (2014)

13. The Purge / Dir. James DeMonaco (2013)

14. A Quiet Place / Dir. John Krasinski (2018)

15. Pulse / Dir. Kiyoshi Kurosawa (2001)