As the World Opens up….

A Window Closes

Globe /

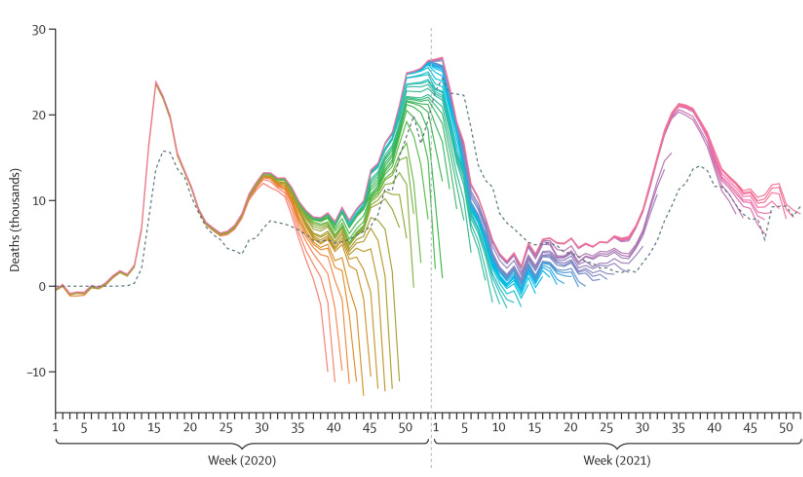

An estimated 18.2M in excess deaths worldwide from COVID-19 and the pandemic conditions. Fudan University synthesized a ‘godsend’ antibody that may neutralize COVID. Freedom of Information Act (FOIA) enforced to require Pfizer to release efficacy trial documents, and FDA and Non-Profit summary reviews to be released in April 2022.

The CERN LHC create a quark-gluon plasma and detects ‘X’ Particle to paint a clearer picture of the Big Bang, MIT discovers a polymerisation that synthesizes ultra-strong barrier coating material. University of Arkansas patent a Graphene Circuit to “provide clean, limitless, low-voltage power for small devices”. Nuclear Fusion research created conditions for a burning plasma to self-sustain with higher energy outputs, showing promise that the International Thermal Nuclear Reactor (ITER) tokamak fusion megaproject is on track for late 2025. James Webb Space Telescope (JWST) may be able to detect alien life form base on air pollution.

Europe /

10M Ukrainians flee (20% of pop.) as Russia invades, Poland accepts 2.3M refugees with many other countries opening their borders. NORD Stream II Pipeline for gas from Russia-Germany is cancelled, Russia bans export of ammonium nitrate a key fertilizer which will impact food production this summer. Russia strikes 10-year energy deal with China.

Africa and Middle East /

Famine is a big concern for Egypt, Ethiopia, Lebanon, Somalia, Sudan, Yemen, and many other countries. South African Parliament set fire in Cape Town. Iran UN Voting rights partial suspended in February, Saudi Arabia considers selling Oil to China via the Yuan.

Asia /

China stores over 50% of grain in preparation for food shortages, with fully Autonomous shipping yards in action in Tianjin. President Khan of Pakistan celebrates India’s independence in purchasing Russian Oil despite Western sanctions, and buy China’s J-10 multirole tactical fighter aircraft. Kazakhstan energy price protests result in overthrowing government, Philippines purchase missile system from India, North Korea promotes new missile and test maneuvering reentry vehicle (MaRV) hypersonic missiles, South Korean elections choose populist conservative Suk-Yeol and brings ties closer to U.S.

South America /

35-year-old Chilean President Boric names a progressive female led cabinet, Venezuela sees U.S. mission in Caracas to thaw ties and U.S. sanctions to energy markets. Bolsonaro although unwell, has removed head of Petrobas in lieu of high gas prices at market rates.

North America /

Canada agrees to 15B for victims of Residential School program, and invoked ‘Emergency Act’ to freeze bank accounts of ‘Freedom’ Trucker Convoy supporters and forcing private industry to remove barricades in Ottawa and key border entry locations. The Bank of Canada works with MIT on Crypto-based Central Bank Digital Currency (CBDC) project. U.S. look to nominate Ketanji Brown Jackson as Supreme Court Justice. Jamaica issues interest to de-couple from Britain.

Market Finances

Digital v. Real World Commodities

The Investment world is unsure of the future, and it all seems a gamble. Simply look at Cathie Wood, the CEO of Ark Investment Management who has fared well over the last few years as her funds excelled with risky investments in future technologies. But as a new market arises, her predictions of Oil dropping to $12/barrel proven wrong and debates with Warren Buffet over railroads – shows there is a new / unforeseen investment future on the horizon.

New World

SEC v. Ripple – the government attempts to classifies the crypto-coin as a security and not a currency.

XRP has headwinds of winning the suit, its role as a decentralized finance (DeFi) for cross border payments looks firm.

Regardless, SEC will expand regulations in 2022 on DeFi trading sites and coins.

The Garante fines Clearview AI 20 euros for violating GDPR with its facial recognition tech.

Microsoft attempts to buy Activision Blizzard for 69B is under review by FTC

Old World

Lumber dropped in March but still at highs over 140% since 2020’s pre-pandemic levels, and will continue in 2022.

Steel is up 300% from pre-pandemic levels, even despite a slow construction market in China.

Corn and Wheat are at 14 year highs with shortages and insecurity driving prices up, North American farmers will do well this year.

Ø Gold – gains 6% this quarter, with best quarter since Q3 2020, a safe-haven in times of geo-political uncertainties and surging inflation.

Ø Oil – surges 30% due to supply chains restructuring in Ukraine/Russia conflict and U.S./China challenging attention from OPEC+

Ø Crypto – Saw deep losses in 30 days, regaining value at the end of the quarter due to regulator confidence and legitimate DeFi projects.

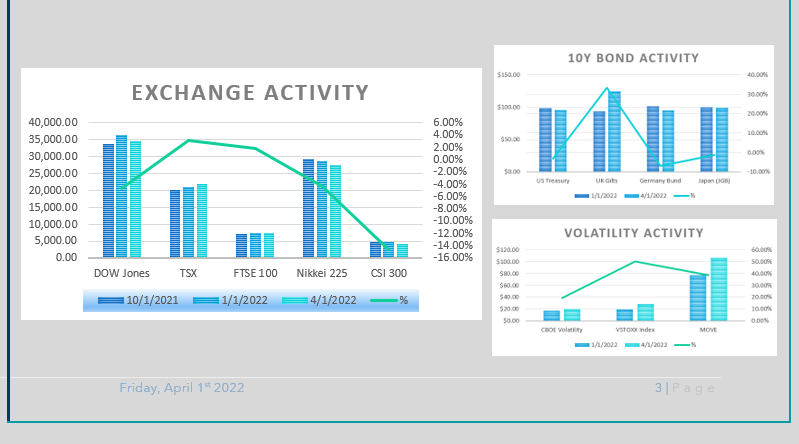

Ø Global Markets – TSX and FTSE rose slightly, however, most exchanges dropped with China’s CSI-300 losing 14%.

Ø Volatility Activity – with VIX more than doubled 2021 lows, you should review your portfolio and lower your stock equity exposure.

Ø Bond Markets – US debt and inflation see worst quarter in 40 years, and UK Gilts hit 6 year high tied to expected interest rate hikes.

Sport & Combat

When Green is greater than Gold

With the heights of instability in the world, many will search out traditions to ground themselves and find a faith in foundational institutions.

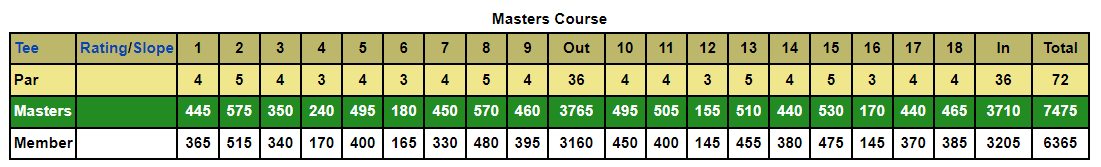

In Sports, the Masters Tournament is the first to kick off the four majors in the Professional Golf Association (PGA) circuit and is steeped in said tradition.

The event is a private country club Invitational-Only that is held at Augusta National Golf Club in Georgia. The grounds, once a former nursery plantation “Fruitland”, were even used in 1943-45 as a turkey and cattle farm for the WWII War effort. It is now home to one of the Top 10 Golf Courses in the world.

In 1934, Golfer Bobby Jones and Investor Clifford Roberts converted the grounds, co-designed by Alister McKenzie, to hold the first Masters. Since 1949, each of its champions are awarded a Green Jacket, which must be returned at the start of the following years tournament. The jacket remains the players personal property and stored in the clubs cloakroom. Since 1952, the Champions Dinner is held on the Tuesday before the tournament with the menu selected by the previous year’s winner. In 1963, the tournament starts with past winners taking a tee shot to kick of the round.

Following the first Sunday in April, the tournament starts on the Thursday with the first of 4 rounds of 18-holes and is set to end that next Sunday. Top tier Golfers are invited, with the 50 best golfers currently listed out in the Championship Committee of the Royal and Ancient Golf Club of St Andrews.

After 36 holes, the field is cut-off with only the top 50 continuing into the weekend. If at the end of fourth round there is no clear winner, then a Sudden-Death round will start at the 18th tee until a clear winner prevails through a hole-by-hole finale.

The event celebrates the lowest daily round, eagles, and holes-in-one with crystal trophies. Silver trophies and medals are presented to winners, runners-up, and lowest scoring amateur. The champion receives their Green Jacket and an invite to each U.S. Open, The Open Championship and the PGA Championship, and Membership to the PGA for 5 seasons.

When the tournament started in 1934, on what is now the back-nine, the winner Horton Smith won $1,500 out of a purse of $5,000. In 2021, the Masters Tournament purse was $11,500,000 with $2,070,000 going to the winner, Hideki Matsuyama.

Being an aged private men’s club, the Golf Club has developed its policies over the years, in extending membership to select women, and dropping its requirement all caddies were black. Clifford Roberts was adamant all golfers were white, but 6 years after his passing in 1983 these rules opened.

Throughout its history, the event garnered attention when Gene Sarazen hit a Double-Eagle (Albatross) on a par 5 in 1935, commemorated 32 years later when the Double Eagle Trophy was awarded to Bruce Devlin who also managed this feat. The 1960 & 70’s solidified the Masters importance as it became household event, as Arnold Palmer, Jack Nicklaus and Gary Player grabbed the attention through their sports legacies. The following years, saw players like Tiger Woods, Greg Norman and Phil Mickelson who established some great highlights in the event and cemented the tournaments importance in golf.

This year in 2022, viewers take bets on whether no.1 Jon Rahm will be beat out by McIlroy, Spieth or Koepka? Will Hideki Matsuyama take it again or could a wild card like Tiger return to show up after 17 months out of circuit? Although it’s clear Phil Mickelson won’t show up due to controversy, the rest of us will just have to wait and see how the story will be written at the end of the event.

Forecast

The Gold Standard

With all the uncertainty in the global landscape, the financial world knows it will be a volatile year, but not much more than that.

As conflict in Europe requires everyone to choose sides, the global supply chains will continue to see instability as trading partners and routes are upset.

Inflationary pressures will need central banks to raise rates to cool inflation, but will it be enough?

Enthusiasts for Gold and Silver will promote the commodities as a buffer against inflation. The long-term value and liquidity of the metals provide a secure investment, and a good way to diversify a portfolio in uncertain times. If the demand increases throughout the year the spot price may increase, which can be mitigated by buying throughout the year. These commodity investments are not meant compete with performance based portfolio, but a different method to save.

Various ways to purchase precious metals…

Invest in mining stocks - Asante Gold Corp. (ASE.CX), Barrick Gold (NYSE:GOLD)

EFT Funds - SPDR Shares (GLD), or Sprott Physical Bullion Funds

Partner with international third-party storage vaults (Goldbroker, or Goldmoney)

Purchase Gold Certificates, or Allocated Gold Certificates

How to Physically Buy Metals

Bars and Grams - Buy weighted grams and oz. of the metal from a reputable country (Argentina, Australia, Canada, Germany, Swiss, United Kingdom, United States). The purity of the metal should approach .9999 and be weary of any value below .95. Choose the best price range, based on your ability to hold for the transferability in future sales. If you purchase an oz of gold today, you will have $2,000 USD value and will be able to easily resell this with your dealer. If you buy a kilo of gold at $80,000 USD, it will take time to find a buyer in future sale.

Collectibles and Coins - Numismatics, the study of currency, provides an opportunity to invest in both the metals and a collectible that may appraise due to its unique design value. However, coins include a premium above the cost of the metal. Coins do take more labour to mint, and the collectability may or may not push up the value.

Daily Purchase Limits – If you buy over $10K per day, your dealer needs to complete a large cash FINTRAC report.

Taxes – Gold / Silver are not taxed at time of sale, however, Platinum / Palladium are subject to tax.

How to source a Reputable Dealer

A key tip to finding a reputable dealer to purchase from; reference the list of authorized dealers for a specific Mint. The Canadian Mint – has a list of Canadian, U.S., and International Dealers that have been carefully vetted out to distribute Canadian minted coins. Some banks also sell Gold directly and will have trusted product.

The dealer will add a premium to the rate as their business cost. When there is higher demand, the dealer will mark up the cost. The dealer will provide daily real time rate catalogue of products to choose from to allow you to select metals based country mint and purity.

The end goal of purchasing physical bars and coins, is to provide a diverse portfolio option and way to store your wealth in a trusted and transferrable way – even in times of deep uncertainty.

Politics & Religion

West v. East

(European Edition)

February 24th, 2022 - Russia leads a campaign into the Donbas region of Ukraine, Luhansk and Donetsk to support the Russian speaking communities facing persecution from an elitist “neo-Nazi” government.

The Kremlin’s military drive was expected to swiftly annex the region, similar to the 2014 campaign into Crimea.

Instead, they faced a defiant Ukraine population.

The attack not only shows the age in Russia’s military might, but this miscalculation also has the Russian population questioning the leadership who messaged a campaign where they would be received as liberators.

As Russia faced a fierce opposition from the ground, couldn’t control the air and as the situation drew on – it demanded a reaction from the rest of the world to take their sides.

North Atlantic Treaty Organization (NATO)

Earlier this year Vladimir Putin mobilized the Russian army on Ukrainian borders during annual war games, and in turn the West opened dialogue with Ukraine to join NATO. The consideration alone is an obvious threat to Russian sovereignty, as the West would house more military forces on its border.

Russia will reference, although contested, a negotiation in 1990 between U.S. Secretary of Defense Baker and Soviet leader Gorbachev during the reunification of Germany that the West agreed NATO forces would not move 1 inch beyond East Berlin.

With the West challenging this position in 1999, under U.S. Clinton Administration where NATO moved into Poland, Czech Republic, and Hungary.

Energy and PetroDollars

As a lead up to and outcome of this war, Energy supply chains will be a key part of the dialogue and may be restructured for years to come.

On February 4th 2022, Chinese-Russian relations strengthened as they announced 30-year Energy deal at the Beijing Winter Olympics.

With the expansion of the ‘Power of Siberia’ pipeline to be completed in 2-3 years, Russia will supply 10 billion cubic metres of gas per year.

Further cooperation between Huawei Technologies and crude oil supplier Rozneft will help build future opportunities.

This deal reflects changes in the energy market and could upset the standard of Oil and Gas being traded via the U.S. Dollar. This change would warrant the U.S. to raise to war-like levels as has been seen in the past with Iraq and Libya threatening similar changes to the order.

As Donald Trump predicted at 2018 United Nations session, Germany needed to heed awareness of dependence on Russian Energy. This position was challenged at the beginning of the days of the fighting on the Ukrainian borders, but eventually Germany aligned with the West.

There are even consideration that the Nord Steam 2 pipeline in the North Sea is cancelled, which would have seen transfer of gas directly from Russia to Germany without being transferred through other countries at a surplus. As per Victoria Nuland, Undersecretary of State for Political Affairs “Nord Stream 2 is now dead”.

These events in 2022, may overshadow the those of 2020, as new lines and allegiances are being drawn in the geo-political landscape.

If diplomacy does not settle in within weeks and months, a future new order will arise and it is not guaranteed who will take over global supremacy, and moreso how they will do it.

Mixtape XXVI

2022 has hit hard.

People are exhausted, tired, and arguing with one another – at the same time they are questioning their own political positions and bank accounts.

This year looks ready to run straight into uncertainty, but one thing that is for sure, musicians are dropping straight gold.

Here are some of the new hits, sprinkled with a few oldies.

Tunes

1. – Black Hot Soup – King Gizzard and the Lizard Wizard – remix DJ Shadow (KGLW)

2. – Labyrinthitis – Destroyer (Merge)

3. – Chocolate Hills – Khruagbin ft. Leon Bridges (Dead Oceans)

4. – SICK, NERVOUS & BROKE! – jpegmafia (Eqt)

5. – Lights Out – Fred Again… (Atlantic)

Wellness & Mindscape

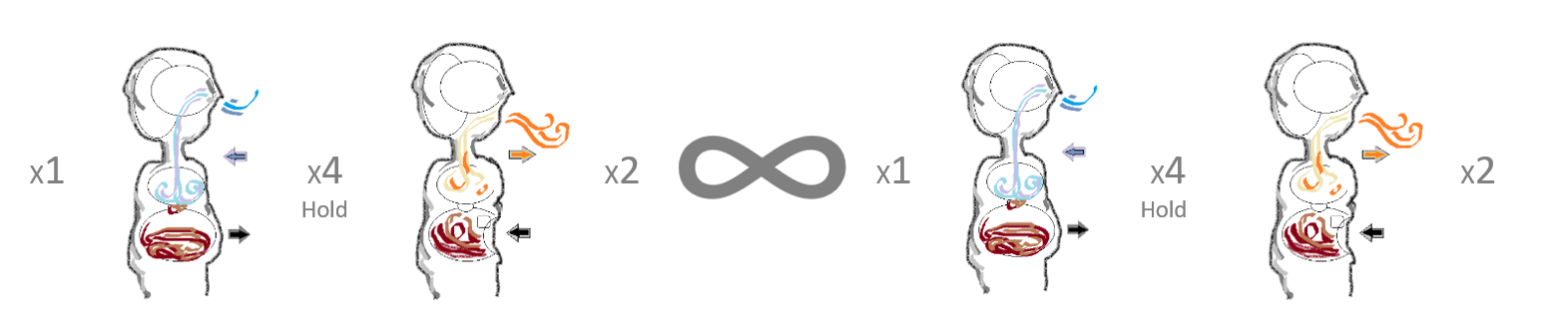

Take a Breathe.

-

Take a big, deep, healthy breath – and hold it for 4 times as long as you inhaled.

As you hold…observe your posture, your stomach and diaphragm, and then ask yourself am I breathing correctly?

Now exhale, twice as long as you inhaled.

If you lifted your shoulders up and puffed out your chest, this is referred to as Vertical Breathing, and this is not the most effective way to take a deep breath. This approach brings air to the top of the lungs and by contracting the bottom then less oxygen is absorbed.

Although this is not how people start life breathing, it has been learned by many over time. The technique can be due to poor posture, an increase in weight towards obesity or even air pollution that cause some of us to fall into shallow breathing practices. The result can amplify stress, which can cyclically further impact shallow breathing.

-

Breathe through your nose – “nostrils filter, warm and humidify air in a way that the mouth cannot”.

o Mouth breathing is often necessary during high activity.

Expand your belly – as air moves down to the stomach your belly expands, your diaphragm contracts and the lungs expand.

Hold your breath – comfortably hold the air for a few moments

Most Importantly Exhale – slowly and silently exhale by gradually contracting your abdominal muscle to expel the air out of your mouth.

Repeat…

-

With the right breathing, one should identify a series of health benefits from short and long term experience. The increase in air to the lungs, will allow for greater amounts of oxygenated blood to travel through body.

Respiration, alongside skeletal movement, are the two support functions driving the flow of the lymphatic system. Deep breathing “helps eliminate toxins, improve metabolism, assist the intestinal lymph nodes to absorb fat, and also boosts the body’s immune system”.